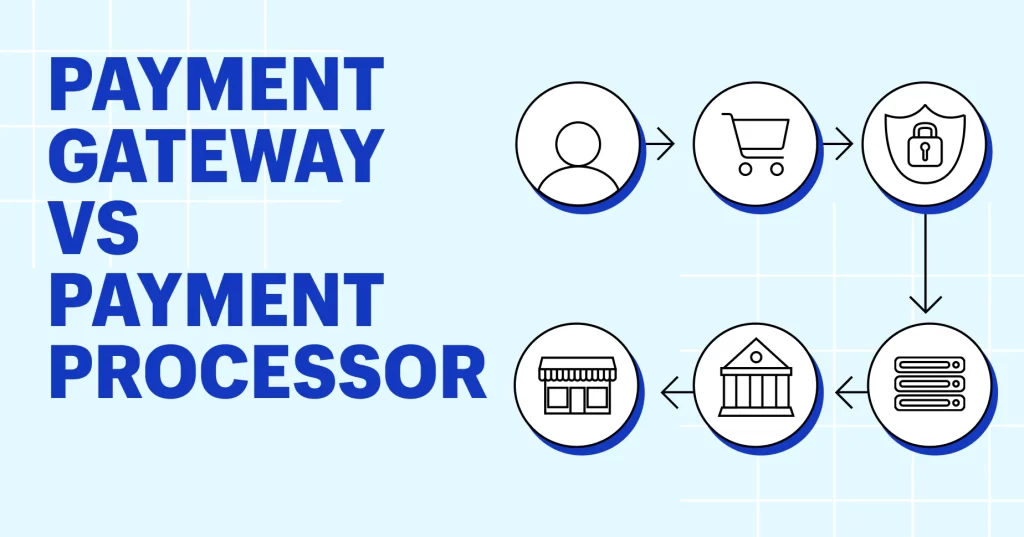

The payment gateway and payment processor are responsible for validating the transaction from merchants, initiating the transactions, and forwarding the request to the card-issuing bank. However, each term has a different meaning and responsibilities.

In this blog, we will do a comparison between Payment Gateway Vs Payment Processor and understand Whats Is the Difference.

What is the Payment Gateway?

Payment gateway refers to the interface between payment processors and vendors. It authorizes the transactions for land-based retailers and eCommerce store owners. The role of the payment gateway is to approve the payment request from the vendor and pass it onto the payment processor for further validation. Before the processor could facilitate the payment, a transaction has to be authorized by the payment gateway. The payment gateway you choose decides can accept or decline the transaction requests.

The most common form of payment gateway solutions is TrustCommerce, Plug N Pay, Chase Paymentech Orbital, Cybersource, CenPOS, PayPal Payflow, Virtual Merchant, First Data Global Gateway, Authorize.net, and more.

What is the Payment Processor?

The payment processor is responsible for facilitating the transaction, once it receives the validation from the payment gateway. These servers have a direct connection with the bank institutions and card companies such as MasterCard or Visa. As soon as the payment gateway validates the transaction request, it forwards the same to the payment processor.

On receiving the payment request from the merchant, the payment processor forwards it to the card-issuing institution for further validation. Commonly known as acquirers, payment processors manage real-time transactions.

The popular form of payment processors is Heartland, WorldPay, Chase Paymentech, TSYS, Omaha, Elavon, Global, Vantiv, BuyPass, First Data, and more.

Payment Gateway VS Payment Processors

Though payment gateway allows easy set-up with the vendors’ eCommerce site or application, it can be quite expensive. The vendors can save on the extra expenses by skipping the payment gateway and integrating the processor only. Here are some factors that must be considered when choosing between the payment processor and payment gateway.

- Transaction Volume: Payment processors charge fees based on transactions. Some payment processors charge a small amount of fee for a high volume of transactions.

- Set up cost and time: The total cost and time required for the integration of the payment processor with a merchant’s application are higher than a payment gateway. Merchants need to complete the certification process to set up the payment processor. The role of the payment gateway is limited to approving transaction requests from merchants and customers. That being said, its set-up time and cost is comparatively lower than payment processors. They only involve a single API layer that approves and processes the transactions.

- Compliances: Payment processors come with strict compliance and PCI-certified solutions. On the other hand, the payment gateway requires the merchants to comply with the ISO 8583 integration.

- Settlement: The payment gateway manages the transaction settlement on behalf of the vendor whereas the payment processor asks vendors to forward the settlement request and manage the settlement file.

These were the major factors the merchants should consider before choosing between the Payment Gateway and Payment Processor.